Case Intelligence for BFSI

Designed for Banks, NBFCs and Fintechs facing rising complaint volumes, audit escalations, and tension between DPDP data minimisation and long-term regulatory retention.

Complaints Inbound Operational Risk

As complaint volumes rise, small inefficiencies compound into operational risk, escalations and audit stress.

Pressure

Rising inbound volume

Complaints flow in from apps, branches, partners and regulators.

Friction

Manual tagging & routing

Teams rely on judgement calls, emails and spreadsheets.

Blind spot

Repeat issues unseen

Similar complaints handled in isolation across teams.

Stress

Audit-heavy reviews

Evidence is reconstructed manually under time pressure.

Risk

Explainability gap

Retain less data, yet explain every decision to regulators.

ArthaShield – Case Intelligence MVP

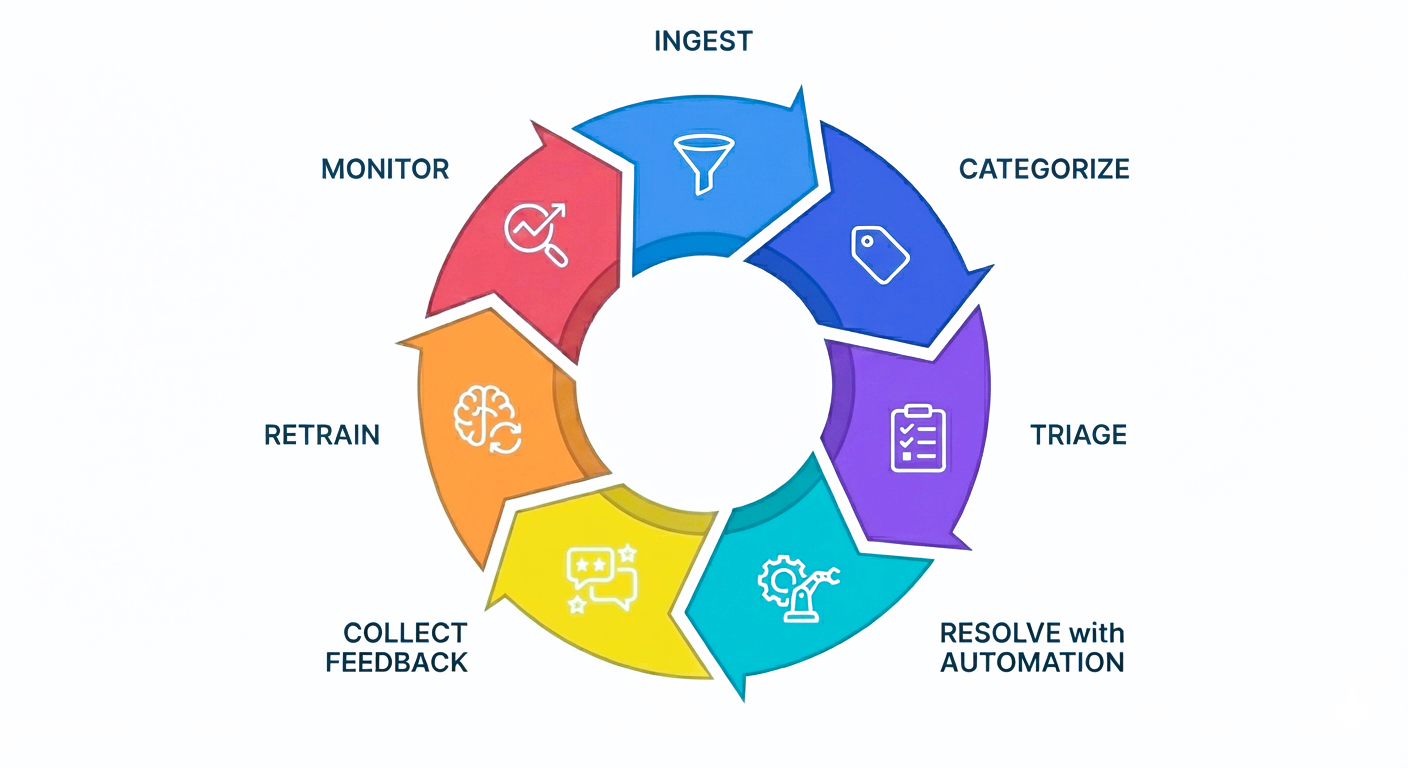

One focused lifecycle — designed to improve complaint handling without rip-and-replace or process upheaval.

Case intelligence built for regulated environments

- BFSI-specific complaint classification

- Product, issue and channel detection

- Similarity linking across cases

- Configurable rules and human override

Designed for privacy and audit readiness

ArthaShield is built with privacy-by-default principles, helping institutions minimise unnecessary personal data exposure while preserving the operational history required for audits, reviews and investigations.

Instead of storing everything forever, the platform focuses on retaining what matters — and clearly explaining what happened at every step.

- Capture only the data required for complaint handling and statutory retention

- Separate short-lived personal identifiers from long-lived case intelligence

- Maintain visibility into who accessed a case, when and why

- Configure retention policies by product, issue type and regulation

The platform relies on proven enterprise grade technologies to ensure transparency, scalability and long-term sustainability — without creating opaque data silos.

Join early-access beta for BFSI

We’re onboarding a limited set of Banks, NBFCs and Fintechs to co-build the next generation of case intelligence.

Request early access